- #QUICKEN FOR MAC VS WINDOWS HOW TO#

- #QUICKEN FOR MAC VS WINDOWS SOFTWARE#

- #QUICKEN FOR MAC VS WINDOWS FREE#

- #QUICKEN FOR MAC VS WINDOWS WINDOWS#

The good news is that nowadays there’s some great personal finance software for Mac that not only do a better job, they don’t require a monthly or annual subscription to use.

#QUICKEN FOR MAC VS WINDOWS WINDOWS#

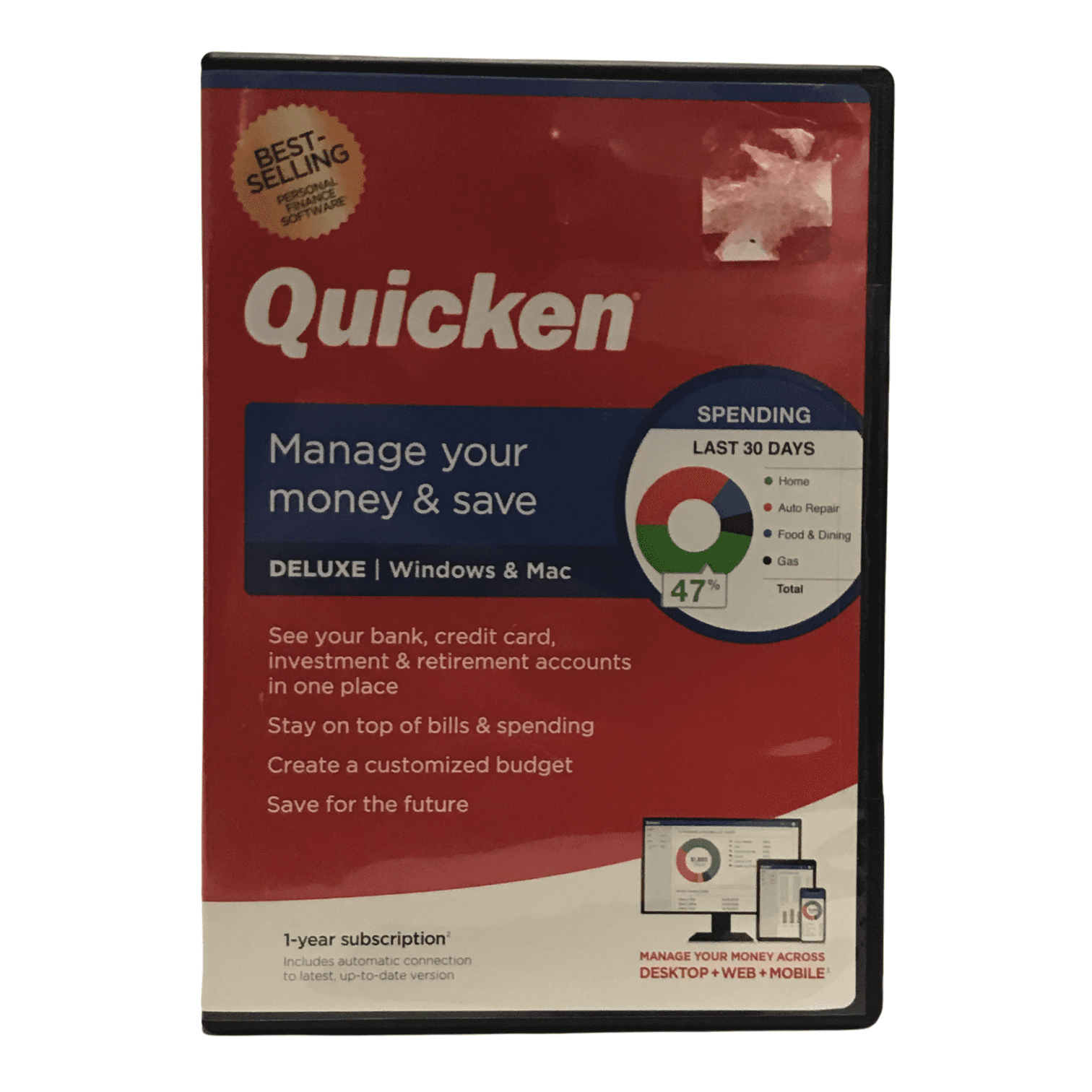

The latest version of Quicken For Mac in 2022 still hasn’t caught-up with the Windows version leaving many Mac users dissapointed. The Mac version of Quicken has lagged behind the Windows version for years and even though Quicken 2019 For Mac was an improvement, the decision to make Quicken subscription only was the final straw for many faithful users. Intuit, the current owner of QuickBooks and Mint, developed the software but sold it to another company several years ago.If you’ve finally had it with Quicken, we’ve taken a closer look at the best personal finance software for Mac of 2022 that make excellent alternatives to Quicken for Mac. That's before most of us had computers, if we were alive at all! It has a lot of history, since the first version came out in 1983. Many people think of Quicken as the original money management app. There's both a web and a mobile version to monitor your money at your computer or on the go. Because it's free, you have nothing to lose by giving it a try.

#QUICKEN FOR MAC VS WINDOWS FREE#

I regularly suggest this free money management app to friends and family. That compounds to tens of thousands of dollars in savings over time. That led me to make some changes, and ultimately I saved $300 per year in fees. When I signed up back in 2012, I used Personal Capital's tools to take a closer look at the investment fees on my mutual funds and ETFs. Just connect your financial accounts and Personal Capital will take care of the rest. Personal Capital breaks down your asset allocation, shows your portfolio performance by account or across accounts, calculates your net worth and gives a high-level overview of your cash flow by category. The free online money tools do an excellent job of helping you understand your investments. The only “string attached” is that the company may try to sell you on its investment services if you have $100,000 or more in investable assets. You can use the investment tools even if you don't pay to use Personal Capital as an investment manager. It's an investment management service that also offers a free personal finance dashboard. Personal Capital, Quicken and Moneydance each give you a digital personal finance dashboard with the most important details about your money at your fingertips. But if you need more help with budgeting than investing, one of the others could be worth the price. If your sole focus is cost, jump right to Personal Capital, which offers a free financial analysis tool. Depending on what you want from a money management app, you may find that one is a better fit than the others for your needs. Wouldn't it be great to have a way to view them all together? However, it's likely you have several separate investment, credit card and bank accounts. If you're serious about your money, you know it's important to keep tabs on your various financial accounts. We may receive compensation when you click on links to those products or services This article/post contains references to products or services from one or more of our advertisers or partners.

#QUICKEN FOR MAC VS WINDOWS HOW TO#

How to Boost Your Savings With a CD Ladder.What’s the Difference Between Saving and Investing?.Best High-Yield Savings Accounts For 2021.

0 kommentar(er)

0 kommentar(er)